Towards the end of 2022, the freight volume in the bulk transportation market will pick up again and the freight rate will stop falling. However, the trend of the market next year is still full of uncertainties. Rates are expected to plummet "almost to the variable cost range". There has been a wave of panic since China lifted restrictions on the outbreak in December. Employment at factory trading companies fell sharply by a third at the end of December. It will take about 3-6 months for domestic and external demand to recover to two-thirds of the pre-epidemic level.

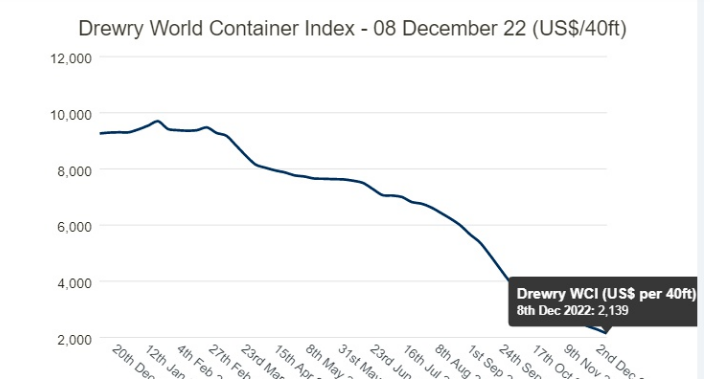

Since the second half of 2022, the freight transportation rate has been declining all the time. Inflation and the Russia-Ukraine war have inhibited the purchasing power of Europe and the United States, coupled with slow inventory digestion, and the freight volume has decreased significantly. Shipments from Asia to the US plunged 21 per cent in November from a year earlier to 1.324,600 TEUs, up from 18 per cent in October, according to Descartes Datamyne, a US research firm.

Since September, the decline in freight volumes has widened. Container shipments from Asia to the U.S. fell for the fourth straight month in November from a year earlier, underscoring sluggish U.S. demand. China, which had the highest rate by land loading, saw a 30 percent drop, the third consecutive month of more than 10 percent decline.Vietnam saw a surge of 26 percent due to a low base period last year as the coronavirus pandemic slowed production and exports.

However, there has been a rush tide in the recent freight market. The cargo volume of Evergreen Shipping and Yangming Shipping in the United States has returned to the full state. In addition to the effect of shipment before the Spring Festival, the continuous unsealing of mainland China is also the key.

The global market is beginning to embrace the small peak season of shipments, but next year will still be a challenging year. While the signs of an end to the decline in freight rates have appeared, it is difficult to predict how far the rebound will be. Next year will affect the most important changes in shipping rates, the IMO two new carbon emissions regulations will take effect, the global focus on the wave of ship breaking.

Large cargo carriers have begun to adopt various strategies to cope with the decline in cargo volume. First, they have begun to adjust the operation mode of the Far East-Europe route. Some flights have chosen to bypass the Suez Canal and reroute to the Cape of Good Hope and then to Europe. Such a shift would add 10 days to the journey time between Asia and Europe, saving on Suez tolls and making slower travel more compliant with carbon emissions. Most importantly, the number of ships needed would increase, indirectly diluting the new capacity.

1. Demand will remain low in 2023: seaborne prices will remain low and volatile

"The cost of living crisis is eating into consumers' spending power, leading to less demand for imported container goods. There is no sign of a solution to the problem on a global scale, and we expect sea volumes to decline." Patrik Berglund predicted, "That said, if the economic situation deteriorates further, it could get worse."

It is reported that ONE shipping company said it is difficult to predict the development of the bulk shipping market next year. The container market has stagnated in the past few months after the sharp drop in spot freight rates and demand. "Forecasting the overall business environment has become more difficult in the face of increasing uncertainty," the company said.

He outlined a number of risk factors: "For example, the ongoing Russia-Ukraine conflict, the impact of quarantine policies, and labor negotiations at the Spanish and American ports." Beyond that, there are three areas of particular concern.

Sharp drop in spot rates: SCFI spot rates peaked at the beginning of January this year, and after a sharp decline, the total drop is 78% since the beginning of January. The Shanghai-Northern Europe route is down 86 percent, and the Shanghai-Spanish-American Trans-Pacific route is down 82 percent at $1,423 per FEU, 19 percent lower than the 2010-2019 average.

Things could get worse for ONE and other carriers. ONE expects operating costs to keep rising and freight rates to keep falling as inflation soars into double digits.

On the earnings front, will the expected decline from Q3 to Q4 continue at the same rate through 2023? "Inflationary pressures are expected," Mr ONE replied. The company has cut its earnings forecast for the second half of its fiscal year and said operating profit more than halved compared with both the first and second half of last year.

2. long-term contract prices are under pressure: shipping prices will continue to fluctuate at a low level

In addition, with spot rates plummeting, shipping companies say that previous long-term contracts are being renegotiated to lower rates. When asked if its customers had asked for a reduction in contract prices, ONE said: "When the current contract is about to expire, ONE will start discussing renewal with customers."

Kepler Cheuvreux analyst Anders R.Karlsen said: "The outlook for next year is a bit bleak, contract prices will also start negotiating at a lower level and carriers' earnings will normalise." Alphaliner previously calculated that shipping companies' revenue was expected to decline between 30% and 70%, based on preliminary forecast data reported by shipping companies.

Falling consumer demand even means carriers are now "competing for volume," according to the Xeneta CEO. Jørgen Lian, senior analyst at DNB Markets, predicts that the bottom line in the container market will be tested in 2023.

As James Hookham, president of the Global shippers' Council, points out in his quarterly review of the container shipping market, released this week: "One of the big questions going into 2023 is how much of their declining volumes shippers will commit to renegotiating contracts and how much volume will be set aside for the spot market. The spot market is expected to fall below pre-pandemic levels in the coming weeks. "

Post time: Feb-14-2023